Economy of Tunisia

This article has multiple issues.Please helpimprove itor discuss these issues on thetalk page.(Learn how and when to remove these template messages)

|

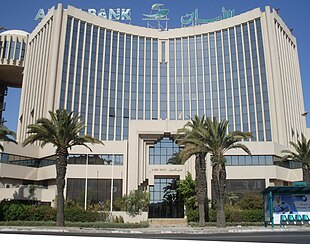

Amen Bank, one of the biggest banks in the country | |

| Currency | Tunisian dinar(TND,د.ت) |

|---|---|

| calendar year | |

Trade organisations | African Union,AfCFTA(signed),WTO,COMESA,CEN-SAD,AMU |

Country group |

|

| Statistics | |

| Population | |

| GDP | |

| GDP rank | |

GDP growth |

|

GDP per capita | |

GDP per capita rank | |

GDP by sector |

|

Population belowpoverty line | |

| 32.8medium(2015)[10] | |

Labour force | |

Labour force by occupation |

|

| Unemployment | |

| $360 monthly (2023)[15] | |

Main industries | petroleum,mining(particularlyphosphate,iron ore),tourism,textile,footwear,agriculture,beverages,olive oil |

| External | |

| Exports | |

Export goods | clothing, semi-finished goods and textiles, agricultural products, mechanical goods, phosphates and chemicals, hydrocarbons, electrical equipment |

Main export partners |

|

| Imports | |

Import goods | textiles, machinery and equipment, hydrocarbons, chemicals, foodstuffs |

Main import partners | |

FDIstock | |

Grossexternal debt | |

| Public finances | |

| −5.8% (of GDP) (2017 est.)[6] | |

| Revenues | 10.957 billion (2022 est.)[6] |

| Expenses | 12.523 billion (2022 est.)[6] |

All values, unless otherwise stated, are inUS dollars. | |

The economy ofTunisiais in the process of beingliberalizedafter decades of heavy state direction and participation in the country's economy. Prudent economic and fiscal planning has resulted in moderate but sustained growth for over a decade. Tunisia'seconomic growthhistorically has depended onoil,phosphates,agri-food products,car parts manufacturing,andtourism.In the World Economic ForumGlobal Competitiveness Reportfor 2015–2016, Tunisia ranks in 92nd place.[21]

The year 2015 was marked by terrorist attacks in Tunisia which are likely to affect economic growth, especially in tourism, one of the main sectors.[22]

Historical trend

[edit]GDP per capita soared by more than 380% in the seventies (1970–1980: USD 280–1,369). But this proved unsustainable and it collapsed to a cumulative 10% growth in the turbulent eighties (1980–1990: USD 1,369–1,507), rising again to almost 50% cumulative growth in the nineties (1990–2000: USD 1,507–2,245), signifying the impact of successful diversification.[23]

Growingforeign debtand theforeign exchangecrisis in the mid-1980s led the government to launch astructural adjustmentprogram to liberalize prices, reducetariffs,and reorient Tunisia toward amarket economyin 1986. Tunisia's economic reform program was lauded as a model byinternational financial institutions.The government liberalized prices, reduced tariffs, lowered debt-service-to-exports and debt-to-GDPratios, and extended the average maturity of its $10 billion foreign debt. Structural adjustment brought additional lending from theWorld Bankand other Western creditors. In 1990, Tunisia acceded to theGeneral Agreement on Tariffs and Trade(GATT) and is a member of theWorld Trade Organization(WTO).

In 1996 Tunisia entered into an "Association Agreement" with theEuropean Union(EU) which removed tariffs and othertrade barrierson most goods by 2008. In conjunction with the Association Agreement, the EU is assisting the Tunisian government'sMise A Niveau(upgrading) program to enhance the productivity of Tunisian businesses and prepare for competition in the global marketplace.

The government totally or partially privatized around 160state-owned enterprisesafter theprivatizationprogram was launched in 1987. Although the program is supported by the GATT, the government had to move carefully to avoid mass firings.Unemploymentcontinued to plague Tunisia's economy and was aggravated by a rapidly growing workforce. An estimated 55% of the population is under the age of 25. Officially, 15.2% of the Tunisian workforce is unemployed.

In 2011, after theArab Spring,the economy slumped but then recovered with 2.81% GDP growth in 2014. However, unemployment is still one of the major issues with 15.2% of the labor force unemployed as of the first quarter of 2014. Tunisia's political transition gained new momentum in early 2014, with the resolution of a political deadlock, the adoption of a new Constitution and the appointment of a new government. Thenational dialogue platform,brokered by key civil society organizations, played a crucial role in gathering all major political parties. This consensus will allow for further reform in the economy and public sector.

In 2015, theBardo National Museum attackled to the collapse of the third largest sector of Tunisia's economy;[24]tourism.Tunisian tourist workers in Tunis have said that "tourism is dead, it is completely dead", expressing the severe drop in tourism after the attack.[25]

The number ofragpickersin Tunisia is increasing due to the continuing high level of unemployment, the loss of purchasing power of the most disadvantaged families, and the explosion of plastic waste due to new consumption habits. Ragpickers do not benefit fromsocial protection,granted to professions with a legal status and may be subject to the exploitation of theRecyclingindustry.[26]

The following table shows the main economic indicators in 1980–2017. Inflation under 5% is in green.[27]

| Year | GDP (in Bil. US$ PPP) |

GDP per capita (in US$ PPP) |

GDP

(in bil. US$ nominal) |

GDP growth (real) |

Inflation rate (in Percent) |

Unemployment (in Percent) |

Government debt (in % of GDP) |

|---|---|---|---|---|---|---|---|

| 1980 | 13.6 | 2,127 | 9.6 | n/a | n/a | ||

| 1981 | n/a | n/a | |||||

| 1982 | n/a | n/a | |||||

| 1983 | n/a | n/a | |||||

| 1984 | n/a | n/a | |||||

| 1985 | n/a | n/a | |||||

| 1986 | n/a | n/a | |||||

| 1987 | n/a | n/a | |||||

| 1988 | n/a | n/a | |||||

| 1989 | n/a | n/a | |||||

| 1990 | 16.2% | n/a | |||||

| 1991 | 66.4% | ||||||

| 1992 | |||||||

| 1993 | |||||||

| 1994 | |||||||

| 1995 | |||||||

| 1996 | |||||||

| 1997 | |||||||

| 1998 | |||||||

| 1999 | |||||||

| 2000 | 22.5 | ||||||

| 2001 | |||||||

| 2002 | |||||||

| 2003 | |||||||

| 2004 | |||||||

| 2005 | |||||||

| 2006 | |||||||

| 2007 | |||||||

| 2008 | |||||||

| 2009 | |||||||

| 2010 | |||||||

| 2011 | |||||||

| 2012 | |||||||

| 2013 | |||||||

| 2014 | |||||||

| 2015 | |||||||

| 2016 | |||||||

| 2017 |

External trade and investment

[edit]

In 1992, Tunisia re-entered the private international capital market for the first time in 6 years, securing a $10-million line of credit forbalance-of-paymentssupport. In January 2003Standard & Poor'saffirmed its investment grade credit ratings for Tunisia. TheWorld Economic Forum2002-03 ranked Tunisia 34th in the Global Competitiveness Index Ratings (two places behindSouth Africa,the continent's leader). In April 2002, Tunisia's firstUS dollar-denominatedsovereign bondissue since 1997 raised $458 million, with maturity in 2012.

TheBourse de Tunisis under the control of the state-run Financial Market Council and lists over 50 companies. The government offers substantial tax incentives to encourage companies to join the exchange, and expansion is occurring.

The Tunisian government adopted a unified investment code in 1993 to attract foreign capital. More than 1,600 export-orientedjoint venturefirms operate in Tunisia to take advantage of relatively low labor costs and preferential access to nearby European markets. Economic links are closest with European countries, which dominate Tunisia's trade. Tunisia'scurrency,the dinar, is not traded outside Tunisia. However, partial convertibility exists for bona fide commercial and investment transaction. Certain restrictions still limit operations carried out by Tunisian residents.

The stockmarket capitalisationof listed companies in Tunisia was valued at $5.3 Billion in 2007, 15% of 2007 GDP, by theWorld Bank.[28]

For 2007, foreign direct investment totaled TN Dinar 2 billion in 2007, or 5.18% of the total volume of investment in the country. This figure is up 35.7% from 2006 and includes 271 new foreign enterprises and the expansion of 222 others already based in the country.

The economic growth rate seen for 2007, at 6.3% is the highest achieved in a decade.

On 29 and 30 November, Tunisia held an investment conference with country chiefs from all around the world with pledges that have reached $30 billion to finance new public projects.[29]

As of 2022, Tunisia's government is in need of international help as the economy grapples with a crisis in public finances that has raised fears it may default on debt and has contributed to shortages of food and fuel, according to government critics. As a result, the government announced in December 2022 that they expect to reduce its fiscal deficit to 5.5% in 2023 from a forecast 7.7% this year, driven by austerity measures that could pave the way for a final deal with the International Monetary Fund on a rescue package.[30]

Loan Guarantee

[edit]Source:[31]

On 20 April 2012, U.S. Treasury Secretary[32]and Tunisian Finance MinisterHoucine Dimassisigned a declaration of intent[33]to move forward on a U.S. loan guarantee for Tunisia. The U.S. Government would provide this loan guarantee to enable the Tunisian government to access significant market financing at affordable rates and favorable maturities with the backing of a U.S. guarantee of principal and interest (up to 100 percent).

The support would consist of the U.S. guarantee of Tunisian government-issued debt (or of bank loans made to the Government of Tunisia). This guarantee will significantly reduce the Tunisian government's borrowing costs at a time when market access has become more expensive for many emerging market countries. In the weeks ahead, both governments intend to make progress on a loan guarantee agreement that would allow Tunisia to move forward with a debt issuance.

The ceremony took place at the World Bank immediately following the meeting of Finance Ministers of theDeauville Partnership with Arab Countries in Transition.

Microfinance institutions, such as Enda Tamweel, exist to assist those who are unable to access the regular banking system. This comprises those living in rural or impoverished regions where the informal sector thrives, accounting for 34% of Tunisia's GDP.[34][35]

Enda Tamweel has made over 3 million microloans to over 900,000 people in the 30 years since its inception, infusing more than €1.6 billion into the local economy.[34][35]

Energy

[edit]Tunisia's natural resources are modest when compared to those of its neighbors: Algeria and Libya. This modesty in natural resources forced the country to import oil, which contributed to the rise in the cost of gasoline: on April 26, 2006, the liter crossed the bar of one dinar to sell for 1.50 Tunisian dinars. (a price equivalent to European prices from the point of view of purchasing power parity).[36]

Electricity

[edit]- Production:16.13 Billion kWh (2011)[37]

- Production by source:

- fossil fuel:96.8% (2010)

- hydro:1.7% (2010)

- other:1.5% (2010)

- Consumption:13.29 billion kWh (2010)

- Exports:None (2010)

- Imports:19 million kWh (2010)

Economic structure

[edit]In 2017, the breakdown by economic sector is as follows:

| Economy sector | contribution to GDP |

|---|---|

| Agriculture | 10,1 % |

| Industry | 26,2 % |

| Services | 63,8 % |

Agriculture

[edit]Agriculture - products:olives,grain,tomatoes,citrus fruit,sugar beets,dates,almonds.

In 2018, Tunisia produced:

- 1.5 million tons ofwheat;

- 1.3 million tons oftomato(16th largest producer in the world);

- 825 thousand tons ofolives(7th largest producer in the world);

- 700 thousand tons ofbarley;

- 548 thousand tons ofwatermelon;

- 450 thousand tons ofonion;

- 426 thousand tons ofpepper;

- 423 thousand tons ofpotato;

- 241 thousand tons ofdate(10th largest producer in the world);

- 217 thousand tons ofcarrots;

- 146 thousand tons ofgrape;

- 144 thousand tons oforange;

- 118 thousand tons ofpeach;

- 114 thousand tons ofapple;

- 104 thousand tons ofgrapefruit;

- 102 thousand tons ofmelon.

In addition to smaller productions of other agricultural products, likealmond(66 thousand tons) andsugar beet(76 thousand tons).[38]

See also

[edit]- Economy of Africa

- List of companies based in Tunisia

- United Nations Economic Commission for:Africa&Western Asia

References

[edit]- ^"World Economic Outlook Database, April 2019".IMF.org.International Monetary Fund.Retrieved29 September2019.

- ^"World Bank Country and Lending Groups".datahelpdesk.worldbank.org.World Bank.Retrieved29 September2019.

- ^locations=TN&name_desc=false "Population, total - Tunisia".data.worldbank.org.World Bank.Retrieved3 October2019.

{{cite web}}:Check|url=value (help) - ^abcde"World Economic Outlook Database, October 2019".IMF.org.Retrieved16 November2019.

- ^Rabah, Arezki; Daniel, Lederman; Amani, Abou Harb; Nelly, El-Mallakh; Yuting, Fan; Asif, Islam; Ha, Nguyen; Marwane, Zouaidi (9 April 2020).Middle East and North Africa Economic Update, April 2020: How Transparency Can Help the Middle East and North Africa.World Bank.p. 10.ISBN9781464815614.Retrieved10 April2020.

{{cite book}}:|website=ignored (help) - ^abcdefghij"The World Factbook".CIA.gov.Central Intelligence Agency.Retrieved12 May2019.

- ^"Tunisia - inflation rate 1986-2022".

- ^"Poverty headcount ratio at national poverty lines (% of population) - Tunisia".data.worldbank.org.World Bank.Retrieved20 March2020.

- ^"Poverty headcount ratio at $5.50 a day (2011 PPP) (% of population) - Tunisia".data.worldbank.org.World Bank.Retrieved20 March2020.

- ^"GINI index (World Bank estimate)".data.worldbank.org.World Bank.Retrieved12 May2019.

- ^"Human Development Index (HDI)"(PDF).hdr.undp.org.HDRO (Human Development Report Office)United Nations Development Programme.Retrieved22 November2022.

- ^"Inequality-adjusted Human Development Index (IHDI)".hdr.undp.org.HDRO (Human Development Report Office)United Nations Development Programme.Retrieved22 November2022.

- ^"Labor force, total - Tunisia".data.worldbank.org.World Bank.Retrieved27 November2019.

- ^"Employment to population ratio, 15+, total (%) (national estimate) - Tunisia".data.worldbank.org.World Bank.

{{cite web}}:Missing or empty|url=(help) - ^"Rankings by Country of Average Monthly Net Salary (After Tax) (Salaries And Financing)".www.numbeo.com.

- ^"Tunisia Exports 1965-2022".

- ^ab"Foreign trade partners of Tunisia".The Observatory of Economic Complexity.Retrieved18 June2021.

- ^"Tunisia Trade | WITS | Text".

- ^"Sovereigns rating list".Standard & Poor's.Retrieved26 May2011.

- ^abcRogers, Simon; Sedghi, Ami (15 April 2011)."How Fitch, Moody's and S&P rate each country's credit rating".The Guardian.Retrieved28 May2011.

- ^"Competitiveness Rankings".

- ^Solutions, EIU Digital."Tunisia Economy, Politics and GDP Growth Summary - The Economist Intelligence Unit".country.eiu.com.

- ^"Tunisia: GDP per capita".Index Mundi.Retrieved2 July2012.

- ^"CIA World Factbook".cia.gov.CIA.Retrieved16 July2015.

- ^"Tunisia's tourism grappling with job losses".BBC World.15 July 2015.Retrieved16 July2015.

- ^"A Tunis, les chiffonniers sortent de l'ombre".Le Monde.28 May 2019.Retrieved11 April2022.

- ^"Report for Selected Countries and Subjects".www.imf.org.Retrieved7 October2018.

- ^"Data - Finance".Archived fromthe originalon 5 December 2006.Retrieved2009-12-31.

- ^"Hoping to preserve democracy, Tunisia woos foreign investors".Archived fromthe originalon 30 November 2016.

- ^Amara, Tarek (23 December 2022)."Tunisia seeks to cut fiscal deficit to 5.5% in 2023, led by economic reforms".Reuters.Retrieved28 December2022.

- ^"Treasury Secretary Geithner and Tunisian Finance Minister Dimassi Sign Declaration to Work Toward U.S. Loan Guarantee for Tunisia".U.S. Department of the Treasury.Retrieved13 June2012.

- ^Timothy Geithner

- ^"FAQs: U.S. LOAN GUARANTEE FOR TUNISIA"(PDF).U.S. Department of the Treasury.Archived(PDF)from the original on 27 July 2014.Retrieved13 September2012.

- ^ab"A helping hand for young entrepreneurs in Tunisia".European Investment Bank.Retrieved15 July2021.

- ^ab"EBRD, Enda Tamweel and Attijari Bank supporting microfinance in Tunisia".www.ebrd.com.Retrieved15 July2021.

- ^"Tunisia Energy Situation - energypedia".energypedia.info.Retrieved14 October2021.

- ^"Nation Master".

- ^Tunisia production in 2018, by FAO

External links

[edit]- Historic Growth Trend of Tunisia's Economy, 1962 – 2007

- Economy of TunisiaatCurlie

- Economy of Tunisiaextracted from the CIA factbook public data