Robert D. Arnott

This biographical articleis writtenlike a résumé.(November 2021) |

Robert D. Arnott | |

|---|---|

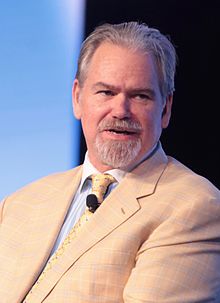

Arnott in 2016 | |

| Born | June 29, 1954 |

| Alma mater | University of California at Santa Barbara |

| Scientific career | |

| Fields | Business,Finance,Investments |

| Institutions | Research Affiliates |

Robert D. Arnott(born June 29, 1954[1]) is an American businessman, investor, and writer who focuses on articles aboutquantitative investing.

He is the founder and chairman of the board ofResearch Affiliates,anasset management firm.Research Affiliates developsinvestment strategiesfor other firms, and there are over US$166 billionassets under the managementof firms using their strategies as of September 2021.[2]He editedCFA Institute'sFinancial Analysts Journalfrom 2002 to 2006, and has edited three books on equity management andtactical asset allocation.[3][better source needed]Arnott is a co-author of the bookThe Fundamental Index: A Better Way to Invest,and co-editor of three other books relating to asset allocation and equity market investing.[4]

Arnott has also served as a Visiting Professor of Finance at theUCLA Anderson School of Management,on the editorial board of theJournal of Portfolio Management,the product advisory board of theChicago Mercantile Exchange,and theChicago Board Options Exchange.[3][better source needed]He previously served as Chairman of First Quadrant, LP, as global equity strategist at Salomon (nowSalomon Smith Barney), president of TSA Capital Management (now TSA/Analytic), and as vice president at theBoston Company.[5]

Arnott has received seven[6]Graham and Dodd Scrolls and Awards, awarded annually by the CFA Institute for best articles of the year, and has received four Bernstein-Fabozzi/Jacobs-Levy awards from theJournal of Portfolio ManagementandInstitutional Investormagazine.[7]

Education and personal life

[edit]Arnott graduated summa cum laude from theUniversity of California at Santa Barbarain 1977 with a degree in economics, applied mathematics and computer science.[5][8]While a high school student in 1970, he attended theSummer Science Program.[9]

He is married with three children. As of 2019, Arnott lived inMiami Beach, Florida.[10]

Writing

[edit]Arnott has published over 130academic papersin refereed journals.[5]Topics of these papers have included the following: mutual fund returns, the equity risk premium, tactical asset allocation, and alternative index investing.

Career

[edit]In college, Arnott contemplated a career in either astrophysics or finance. He opted for finance after deciding his math skills were inadequate for making serious contributions to science, but above average for finance or investing, as he later recalled, "where hardly anyone was using serious math at the time.”[11]

After college, he worked atSalomon Brothersand in 1998 became chairman of First Quadrant, LP.

In 2002, Arnott founded Research Affiliates, aNewport Beach, California-based investment management firm. As of June 30, 2021, about $171 billion in assets are managed worldwide using investment strategies developed by Research Affiliates.[12]The firm has been involved withfundamentally based indexessince mid-2004 and has worked with theFTSE Groupto create indices based on this methodology.[13]Research Affiliates licenses its indexes toSchwab,InvescoandPIMCO.[14]

In November, 2009, Research Affiliates was granted a patent for their index methodology that selects and weights securities using fundamental measures of company size.Laise, Eleanor (November 18, 2009)."Indexing Patent to Test Fund Firms".The Wall Street Journal.

Arnott co-manages thePIMCOAll Asset Fund, a tacticalfund of fundswith $16 billion in assets as of March 2022, which can invest in any of PIMCO's manymutual funds.[15]This fund is intended to feature what Arnott calls "Third Pillar" options, meant to diversify beyond mainstream stocks and investment-grade bonds, and may includemaster limited partnerships,high-yield bonds,emerging marketsdebt, orliquid alternativeswith the goal of boosting long-term portfolio performance.[16]

Political contributions

[edit]Arnott has given $750,000 to support theClub for Growth,a politically conservative group advocating lower tax rates. Arnott considers himself alibertarian,and opposes thePatient Protection and Affordable Care Act.[17] In 2015, Arnott donated $100,000 to America's Liberty PAC, apolitical action committeeformed in support of RepresentativeRand Paul's2016 presidential bid.[18]

References

[edit]- ^Mooney, Attracta (March 18, 2016)."'Godfather of smart beta' defends attack ".Financial Times.

- ^"About Us - Research Affiliates".3 January 2022.

- ^ab""Q&A with Rob Arnott" NAREIT - Capital Markets ". January–February 2007.

{{cite web}}:Missing or empty|url=(help) - ^"Wiley: The Fundamental Index: A Better Way To Invest".

- ^abc"Robert D. Arnott biography".Research Affiliates.

- ^"All Past Graham and Dodd Award Winners".Taylor & Francis.

- ^"Bernstein-Fabozzi/Jacobs Levy Award".

- ^"Fundamental Index ETFs; The difference is fundamental"(PDF).Invesco PowerShares. 2009.RetrievedNovember 29,2010.

- ^"The Universal Times".Summer Science Program. February 2010. Archived fromthe originalon July 28, 2011.RetrievedNovember 29,2010.

- ^"Rob Arnott | La Gorce Island | Miami Dade Most Expensive Homes".4 June 2018.

- ^"Back to Fundamentals with Rob Arnott".

- ^"About Research Affiliates".

- ^"How to Corral an Index Fund (with a new rope)",January 21, 2007,The New York Times

- ^"RA Model Portfolios How to Invest"(PDF).www.researchaffiliates.com.

- ^PIMCO All Asset Fund: Overview.US News and World Report, accessed 06 May 2022

- ^"Rob Arnott on All Asset January 2016".9 February 2016.

- ^Yang, Jia Lynn (11 October 2013)."Here's who pays the bills for Ted Cruz's crusade".Washington Post.Retrieved11 October2013.

- ^"These 2 Donors Are Propping up Rand Paul's Super PAC".HuffPost.24 July 2015.