Free market

| Part ofa serieson |

| Economic systems |

|---|

|

Major types

|

| Part ofa serieson |

| Liberalism |

|---|

|

Ineconomics,afree marketis an economicsystemin which the prices of goods and services are determined bysupply and demandexpressed by sellers and buyers. Such markets, as modeled, operate without the intervention ofgovernmentor any other external authority. Proponents of the free market as a normative ideal contrast it with aregulated market,in which a government intervenes in supply and demand by means of various methods such astaxesorregulations.In an idealizedfree market economy,prices for goods and services are set solely by the bids and offers of the participants.

Scholars contrast the concept of a free market with the concept of acoordinated marketin fields of study such aspolitical economy,new institutional economics,economic sociology,andpolitical science.All of these fields emphasize the importance in currently existing market systems of rule-making institutions external to the simple forces of supply and demand which create space for those forces to operate to control productive output and distribution. Although free markets are commonly associated withcapitalismin contemporary usage andpopular culture,free markets have also been components in some forms ofmarket socialism.[1]

Historically, free market has also been used synonymously with other economic policies. For instance proponents oflaissez-fairecapitalism may refer to it as free market capitalism because they claim it achieves the most economic freedom.[2]In practice, governments usually intervene to reduceexternalitiessuch asgreenhouse gas emissions;although they may use markets to do so, such ascarbon emission trading.[3]

Economic systems[edit]

Capitalism[edit]

| Part ofa serieson |

| Capitalism

(For and against) |

|---|

Capitalism is aneconomic systembased on theprivate ownershipof themeans of productionand their operation forprofit.[4][5][6][7]Central characteristics of capitalism includecapital accumulation,competitive markets,aprice system,private property and the recognition ofproperty rights,voluntary exchange,andwage labor.[8][9]In acapitalist market economy,decision-making and investments are determined by every owner of wealth, property or production ability incapitalandfinancial marketswhereas prices and the distribution of goods and services are mainly determined by competition in goods and services markets.[10]

Economists,historians,political economistsandsociologistshave adopted different perspectives in their analyses of capitalism and have recognized various forms of it in practice. These includelaissez-faireor free-market capitalism,state capitalismandwelfare capitalism.Differentforms of capitalismfeature varying degrees of free markets,public ownership,[11]obstacles to free competition and state-sanctionedsocial policies.The degree ofcompetitioninmarketsand the role ofinterventionandregulationas well as the scope of state ownership vary across different models of capitalism.[12][13]The extent to which different markets are free and the rules defining private property are matters of politics and policy. Most of the existing capitalist economies aremixed economiesthat combine elements of free markets with state intervention and in some caseseconomic planning.[14]

Market economieshave existed under manyforms of governmentand in many different times, places and cultures. Modern capitalist societies—marked by a universalization ofmoney-basedsocial relations,a consistently large and system-wideclass of workerswho must work for wages (theproletariat) and acapitalist classwhich owns the means of production—developed in Western Europe in a process that led to theIndustrial Revolution.Capitalist systems with varying degrees of direct government intervention have since become dominant in theWestern worldand continue to spread. Capitalism has been shown to be strongly correlated witheconomic growth.[15]

Georgism[edit]

For classical economists such asAdam Smith,the term free market refers to a market free from all forms of economic privilege, monopolies and artificial scarcities.[2]They say this implies thateconomic rents,which they describe as profits generated from a lack ofperfect competition,must be reduced or eliminated as much as possible through free competition.

Economic theory suggests the returns tolandand othernatural resourcesare economic rents that cannot be reduced in such a way because of their perfect inelastic supply.[16]Some economic thinkers emphasize the need to share those rents as an essential requirement for a well functioning market. It is suggested this would both eliminate the need for regular taxes that have a negative effect on trade (seedeadweight loss) as well as release land and resources that are speculated upon or monopolised, two features that improve the competition and free market mechanisms.Winston Churchillsupported this view by the following statement: "Land is the mother of all monopoly".[17]The American economist and social philosopherHenry George,the most famous proponent of this thesis, wanted to accomplish this through a highland value taxthat replaces all other taxes.[18]Followers of his ideas are often calledGeorgistsor geoists andgeolibertarians.

Léon Walras,one of the founders of theneoclassical economicswho helped formulate thegeneral equilibrium theory,had a very similar view. He argued that free competition could only be realized under conditions of state ownership of natural resources and land. Additionally, income taxes could be eliminated because the state would receive income to finance public services through owning such resources and enterprises.[19]

Laissez-faire[edit]

Thelaissez-faireprinciple expresses a preference for an absence of non-market pressures on prices and wages such as those from discriminatory governmenttaxes,subsidies,tariffs,regulations,orgovernment-granted monopolies.InThe Pure Theory of Capital,Friedrich Hayekargued that the goal is the preservation of the unique information contained in the price itself.[20]

According to Karl Popper, the idea of the free market is paradoxical, as it requires interventions towards the goal of preventing interventions.[2]

Althoughlaissez-fairehas been commonly associated withcapitalism,there is a similar economic theory associated withsocialismcalled left-wing or socialistlaissez-faire,also known asfree-market anarchism,free-market anti-capitalismandfree-market socialismto distinguish it fromlaissez-fairecapitalism.[21][22][23]Critics oflaissez-faireas commonly understood argue that a trulylaissez-fairesystem would beanti-capitalistandsocialist.[24][25]Americanindividualist anarchistssuch asBenjamin Tuckersaw themselves as economic free-market socialists and political individualists while arguing that their "anarchistic socialism" or "individual anarchism" was "consistentManchesterism".[26]

Socialism[edit]

Various forms ofsocialismbased on free markets have existed since the 19th century. Early notable socialist proponents of free markets includePierre-Joseph Proudhon,Benjamin Tuckerand theRicardian socialists.These economists believed that genuinely free markets andvoluntary exchangecould not exist within theexploitativeconditions ofcapitalism.These proposals ranged from various forms ofworker cooperativesoperating in a free-market economy such as themutualistsystem proposed by Proudhon, to state-owned enterprises operating in unregulated and open markets. These models of socialism are not to be confused with other forms of market socialism (e.g. theLange model) where publicly owned enterprises are coordinated by various degrees ofeconomic planning,or where capital good prices are determined through marginal cost pricing.

Advocates of free-market socialism such asJaroslav Vanekargue that genuinely free markets are not possible under conditions of private ownership of productive property. Instead, he contends that the class differences and inequalities in income and power that result from private ownership enable the interests of the dominant class to skew the market to their favor, either in the form of monopoly and market power, or by utilizing their wealth and resources to legislate government policies that benefit their specific business interests. Additionally, Vanek states that workers in a socialist economy based on cooperative and self-managed enterprises have stronger incentives to maximize productivity because they would receive a share of the profits (based on the overall performance of their enterprise) in addition to receiving their fixed wage or salary. The stronger incentives to maximize productivity that he conceives as possible in a socialist economy based on cooperative and self-managed enterprises might be accomplished in a free-market economy ifemployee-owned companieswere the norm as envisioned by various thinkers includingLouis O. KelsoandJames S. Albus.[27]

Socialists also assert thatfree-market capitalismleads to an excessively skewed distributions of income and economic instabilities which in turn leads to social instability. Corrective measures in the form ofsocial welfare,re-distributive taxation and regulatory measures and their associated administrative costs which are required create agency costs for society. These costs would not be required in a self-managed socialist economy.[28]

Criticism of market socialism comes from two major directions. EconomistsFriedrich HayekandGeorge Stiglerargued that socialism as a theory is not conducive to democratic systems[29]and even the most benevolent state would face serious implementation problems.[30]

More modern criticism of socialism andmarket socialismimplies that even in a democratic system, socialism cannot reach the desired efficient outcome. This argument holds that democratic majority rule becomes detrimental to enterprises and industries, and that the formation ofinterest groupsdistorts theoptimal market outcome.[31]

Concepts[edit]

Economic equilibrium[edit]

Thegeneral equilibrium theoryhas demonstrated that, under certain theoretical conditions ofperfect competition,the law ofsupply and demandinfluences prices toward anequilibriumthat balances the demands for the products against the supplies.[32][full citation needed]At these equilibrium prices, the market distributes the products to the purchasers according to each purchaser's preference orutilityfor each product and within the relative limits of each buyer'spurchasing power.This result is described as market efficiency, or more specifically aPareto optimum.

Low barriers to entry[edit]

A free market does not directly require the existence of competition; however, it does require a framework that freely allows new market entrants. Hence, competition in a free market is a consequence of the conditions of a free market, including that market participants not be obstructed from following theirprofit motive.

Perfect competition and market failure[edit]

An absence of any of the conditions of perfect competition is considered amarket failure.Regulatory intervention may provide a substitute force to counter a market failure, which leads some economists to believe that some forms of market regulation may be better than an unregulated market at providing a free market.[2]

Spontaneous order[edit]

Friedrich Hayekpopularized the view that market economies promotespontaneous orderwhich results in a better "allocation of societal resources than any design could achieve".[33]According to this view, market economies are characterized by the formation of complex transactional networks that produce and distribute goods and services throughout the economy. These networks are not designed, but they nevertheless emerge as a result of decentralized individual economic decisions.[34]The idea of spontaneous order is an elaboration on theinvisible handproposed byAdam SmithinThe Wealth of Nations.About the individual, Smith wrote:

By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for society that it was no part of it. By pursuing his own interest, he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good.[35]

Smith pointed out that one does not get one's dinner by appealing to the brother-love of the butcher, the farmer or the baker. Rather, one appeals to their self-interest and pays them for their labor, arguing:

It is not from the benevolence of the butcher, the brewer or the baker, that we expect our dinner, but from their regard to their own self-interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages.[36]

Supporters of this view claim that spontaneous order is superior to any order that does not allow individuals to make their own choices of what to produce, what to buy, what to sell and at what prices due to the number and complexity of the factors involved. They further believe that any attempt to implement central planning will result in more disorder, or a less efficient production and distribution of goods and services.

Critics such as political economistKarl Polanyiquestion whether a spontaneously ordered market can exist, completely free of distortions of political policy, claiming that even the ostensibly freest markets require a state to exercise coercive power in some areas, namely to enforcecontracts,govern the formation oflabor unions,spell out the rights and obligations ofcorporations,shape who has standing to bring legal actions and define what constitutes an unacceptableconflict of interest.[37]

Supply and demand[edit]

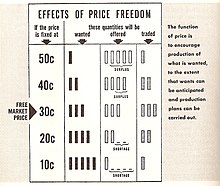

Demand for an item (such as a good or service) refers to the economic market pressure from people trying to buy it. Buyers have a maximum price they are willing to pay for an item, and sellers have a minimum price at which they are willing to offer their product. The point at which the supply and demand curves meet is the equilibrium price of the good and quantity demanded. Sellers willing to offer their goods at a lower price than the equilibrium price receive the difference asproducer surplus.Buyers willing to pay for goods at a higher price than the equilibrium price receive the difference asconsumer surplus.[38]

The model is commonly applied to wages in the market for labor. The typical roles of supplier and consumer are reversed. The suppliers are individuals, who try to sell (supply) their labor for the highest price. The consumers are businesses, which try to buy (demand) the type of labor they need at the lowest price. As more people offer their labor in that market, the equilibrium wage decreases and the equilibrium level of employment increases as the supply curve shifts to the right. The opposite happens if fewer people offer their wages in the market as the supply curve shifts to the left.[38]

In a free market, individuals and firms taking part in these transactions have the liberty to enter, leave and participate in the market as they so choose. Prices and quantities are allowed to adjust according to economic conditions in order to reach equilibrium and allocate resources. However, in many countries around the world governments seek to intervene in the free market in order to achieve certain social or political agendas.[39]Governments may attempt to createsocial equalityorequality of outcomeby intervening in the market through actions such as imposing aminimum wage(price floor) or erectingprice controls(price ceiling).

Other lesser-known goals are also pursued, such as in the United States, where the federal government subsidizes owners of fertile land to not grow crops in order to prevent the supply curve from further shifting to the right and decreasing the equilibrium price. This is done under the justification of maintaining farmers' profits; due to the relativeinelasticityof demand for crops, increased supply would lower the price but not significantly increase quantity demanded, thus placing pressure on farmers to exit the market.[40]Those interventions are often done in the name of maintaining basic assumptions of free markets such as the idea that the costs of production must be included in the price of goods. Pollution and depletion costs are sometimes not included in the cost of production (a manufacturer that withdraws water at one location then discharges it polluted downstream, avoiding the cost of treating the water), therefore governments may opt to impose regulations in an attempt to try to internalize all of the cost of production and ultimately include them in the price of the goods.

Advocates of the free market contend that government intervention hampers economic growth by disrupting the efficient allocation of resources according to supply and demand while critics of the free market contend that government intervention is sometimes necessary to protect a country's economy from better-developed and more influential economies, while providing the stability necessary for wise long-term investment.Milton Friedmanargued againstcentral planning,price controlsandstate-owned corporations,particularly as practiced in theSoviet UnionandChina[41]whileHa-Joon Changcites the examples of post-war Japan and the growth of South Korea's steel industry as positive examples of government intervention.[42]

Reception[edit]

This article maylendundue weightto certain ideas, incidents, or controversies.(November 2023) |

Criticism[edit]

Critics of alaissez-fairefree market have argued that in real world situations it has proven to be susceptible to the development ofprice fi xingmonopolies.[43]Such reasoning has led to government intervention, e.g. theUnited States antitrust law.Critics of the free market also argue that it results in significantmarket dominance,inequality of bargaining power,orinformation asymmetry,in order to allow markets to function more freely.

Critics of a free market often argue that some market failures require government intervention.[44]EconomistsRonald Coase,Milton Friedman,Ludwig von Mises,andFriedrich Hayekhave responded by arguing that markets can internalize or adjust to supposed market failures.[44]

Two prominent Canadian authors argue that government at times has to intervene to ensure competition in large and important industries.Naomi Kleinillustrates this roughly in her workThe Shock DoctrineandJohn Ralston Saulmore humorously illustrates this through various examples inThe Collapse of Globalism and the Reinvention of the World.[45]While its supporters argue that only a free market can create healthy competition and therefore more business and reasonable prices, opponents say that a free market in its purest form may result in the opposite. According to Klein and Ralston, the merging of companies into giant corporations or the privatization of government-run industry and national assets often result in monopolies or oligopolies requiring government intervention toforce competitionand reasonable prices.[45]

Another form of market failure isspeculation,where transactions are made to profit from short term fluctuation, rather from theintrinsic valueof the companies or products. This criticism has been challenged by historians such asLawrence Reed,who argued that monopolies have historically failed to form even in the absence of antitrust law.[46][unreliable source?]This is because monopolies are inherently difficult to maintain as a company that tries to maintain its monopoly by buying out new competitors, for instance, is incentivizing newcomers to enter the market in hope of a buy-out. Furthermore, according to writer Walter Lippman and economist Milton Friedman, historical analysis of the formation of monopolies reveals that, contrary to popular belief, these were the result not of unfettered market forces, but of legal privileges granted by government.[47][unreliable source?]

American philosopher and authorCornel Westhas derisively termed what he perceives asdogmaticarguments forlaissez-faireeconomic policies asfree-market fundamentalism.West has contended that such mentality "trivializes the concern for public interest" and "makes money-driven, poll-obsessed elected officials deferential to corporate goals of profit – often at the cost of the common good".[48]American political philosopherMichael J. Sandelcontends that in the last thirty years the United States has moved beyond just having a market economy and has become a market society where literally everything is for sale, including aspects of social and civic life such as education, access to justice and political influence.[49]The economic historianKarl Polanyiwas highly critical of the idea of the market-based society in his bookThe Great Transformation,stating that any attempt at its creation would undermine human society and the common good:[50]"Ultimately...the control of the economic system by the market is of overwhelming consequence to the whole organization of society; it means no less than the running of society as an adjunct to the market. Instead of economy being embedded in social relations, social relations are embedded in the economic system."[51]

David McNallyof the University of Houston argues in the Marxist tradition that the logic of the market inherently produces inequitable outcomes and leads to unequal exchanges, arguing thatAdam Smith's moral intent and moral philosophy espousing equal exchange was undermined by the practice of the free market he championed. According to McNally, the development of themarket economyinvolved coercion, exploitation and violence that Smith's moral philosophy could not countenance. McNally also criticizes market socialists for believing in the possibility of fair markets based on equal exchanges to be achieved by purging parasitical elements from the market economy such asprivate ownershipof themeans of production,arguing thatmarket socialismis an oxymoron whensocialismis defined as an end towage labour.[52]

See also[edit]

Notes[edit]

- ^Bockman, Johanna (2011).Markets in the name of Socialism: The Left-Wing origins of Neoliberalism.Stanford University Press.ISBN978-0804775663.

- ^abcdPopper, Karl (1994).The Open Society and Its Enemies.Routledge Classics. p. 712.ISBN978-0415610216.

- ^"Finance & Development".Finance & Development | F&D.Archivedfrom the original on 2022-09-15.Retrieved2022-09-15.

- ^Zimbalist, Sherman and Brown, Andrew, Howard J. and Stuart (1988).Comparing Economic Systems: A Political-Economic Approach.Harcourt College Pub. pp.6–7.ISBN978-0155124035.

Pure capitalism is defined as a system wherein all of the means of production (physical capital) are privately owned and run by the capitalist class for a profit, while most other people are workers who work for a salary or wage (and who do not own the capital or the product).

{{cite book}}:CS1 maint: multiple names: authors list (link) - ^Rosser, Mariana V.; Rosser, J Barkley (2003).Comparative Economics in a Transforming World Economy.MIT Press. p. 7.ISBN978-0262182348.

In capitalist economies, land and produced means of production (the capital stock) are owned by private individuals or groups of private individuals organized as firms.

- ^Chris Jenks.Core Sociological Dichotomies."Capitalism, as a mode of production, is an economic system of manufacture and exchange which is geared toward the production and sale of commodities within a market for profit, where the manufacture of commodities consists of the use of the formally free labor of workers in exchange for a wage to create commodities in which the manufacturer extracts surplus value from the labor of the workers in terms of the difference between the wages paid to the worker and the value of the commodity produced by him/her to generate that profit." London; Thousand Oaks, CA; New Delhi. Sage. p. 383.

- ^Gilpin, Robert (2018).The Challenge of Global Capitalism: The World Economy in the 21st Century.Princeton University Press.ISBN978-0691186474.OCLC1076397003.

- ^Heilbroner, Robert L."Capitalism"Archived28 October 2017 at theWayback Machine.Steven N. Durlauf and Lawrence E. Blume, eds.The New Palgrave Dictionary of Economics.2nded.(Palgrave Macmillan, 2008)doi:10.1057/9780230226203.0198.

- ^Louis Hyman and Edward E. Baptist (2014).American Capitalism: A ReaderArchived22 May 2015 at theWayback Machine.Simon & Schuster.ISBN978-1476784311.

- ^Gregory, Paul; Stuart, Robert (2013).The Global Economy and its Economic Systems.South-Western College Pub. p. 41.ISBN978-1285-05535-0.

Capitalism is characterized by private ownership of the factors of production. Decision making is decentralized and rests with the owners of the factors of production. Their decision making is coordinated by the market, which provides the necessary information. Material incentives are used to motivate participants.

- ^Gregory and Stuart, Paul and Robert (2013).The Global Economy and its Economic Systems.South-Western College Pub. p. 107.ISBN978-1285-05535-0.

Real-world capitalist systems are mixed, some having higher shares of public ownership than others. The mix changes when privatization or nationalization occurs. Privatization is when property that had been state-owned is transferred to private owners.Nationalizationoccurs when privately owned property becomes publicly owned.

- ^Macmillan Dictionary of Modern Economics,3rd Ed., 1986, p. 54.

- ^Bronk, Richard (Summer 2000)."Which model of capitalism?".OECD Observer.Vol. 1999, no. 221–22. OECD. pp. 12–15.Archivedfrom the original on 6 April 2018.Retrieved6 April2018.

- ^Stilwell, Frank. "Political Economy: the Contest of Economic Ideas". First Edition. Oxford University Press. Melbourne, Australia. 2002.

- ^Sy, Wilson N. (18 September 2016). "Capitalism and Economic Growth Across the World". Rochester, NY.doi:10.2139/ssrn.2840425.S2CID157423973.SSRN2840425.

For 40 largest countries in the International Monetary Fund (IMF) database, it is shown statistically that capitalism, between 2003 and 2012, is positively correlated significantly to economic growth.

{{cite journal}}:Cite journal requires|journal=(help) - ^Adam Smith,The Wealth of NationsBook V, Chapter 2,Part 2, Article I: Taxes upon the Rent of Houses.

- ^House Of Commons May 4th; King's Theatre, Edinburgh, July 17

- ^Backhaus, "Henry George's Ingenious Tax," pp. 453–458.

- ^Bockman, Johanna (2011).Markets in the name of Socialism: The Left-Wing origins of Neoliberalism.Stanford University Press. p. 21.ISBN978-0804775663.

For Walras, socialism would provide the necessary institutions for free competition and social justice. Socialism, in Walras's view, entailed state ownership of land and natural resources and the abolition of income taxes. As owner of land and natural resources, the state could then lease these resources to many individuals and groups which would eliminate monopolies and thus enable free competition. The leasing of land and natural resources would also provide enough state revenue to make income taxes unnecessary, allowing a worker to invest his savings and become 'an owner or capitalist at the same time that he remains a worker.

- ^Hayek, Friedrich (1941).The Pure Theory of Capital.

- ^Chartier, Gary; Johnson, Charles W. (2011).Markets Not Capitalism: Individualist Anarchism Against Bosses, Inequality, Corporate Power, and Structural Poverty.Brooklyn, NY:Minor Compositions/Autonomedia

- ^"It introduces an eye-opening approach to radical social thought, rooted equally in libertarian socialism and market anarchism." Chartier, Gary; Johnson, Charles W. (2011).Markets Not Capitalism: Individualist Anarchism Against Bosses, Inequality, Corporate Power, and Structural Poverty.Brooklyn, NY: Minor Compositions/Autonomedia. p. back cover.

- ^"But there has always been a market-oriented strand of libertarian socialism that emphasizes voluntary cooperation between producers. And markets, properly understood, have always been about cooperation. As a commenter at Reason magazine's Hit&Run blog, remarking onJesse Walker's link to the Kelly article, put it: "every trade is a cooperative act." In fact, it's a fairly common observation among market anarchists that genuinely free markets have the most legitimate claim to the label "socialism.""Socialism: A Perfectly Good Word Rehabilitated"Archived2016-03-10 at theWayback MachinebyKevin Carsonat website of Center for a Stateless Society.

- ^Nick Manley,"Brief Introduction To Left-Wing Laissez Faire Economic Theory: Part One"Archived2021-08-18 at theWayback Machine.

- ^Nick Manley,"Brief Introduction To Left-Wing Laissez Faire Economic Theory: Part Two"Archived2021-05-16 at theWayback Machine.

- ^Tucker, Benjamin (1926).Individual Liberty: Selections from the Writings of Benjamin R. Tucker.New York: Vanguard Press. pp. 1–19.

- ^"Cooperative Economics: An Interview with Jaroslav Vanek"Archived2021-08-17 at theWayback Machine.Interview by Albert Perkins. Retrieved March 17, 2011.

- ^The Political Economy of Socialism,by Horvat, Branko (1982), pp. 197–198.

- ^Hayek, F. (1949-03-01)."The Intellectuals and Socialism".University of Chicago Law Review.16(3): 417–433.doi:10.2307/1597903.ISSN0041-9494.JSTOR1597903.Archivedfrom the original on 2022-10-27.Retrieved2022-10-27.

- ^Stigler, George J. (1992)."Law or Economics?".The Journal of Law & Economics.35(2): 455–468.doi:10.1086/467262.ISSN0022-2186.JSTOR725548.S2CID154114758.Archivedfrom the original on 2022-10-27.Retrieved2022-10-27.

- ^Shleifer, Andrei; Vishny, Robert W (1994)."Politics of Market Socialism"(PDF).Journal of Economic Perspectives.8(2): 165–176.doi:10.1257/jep.8.2.165.S2CID152437398.Archived(PDF)from the original on 2014-02-02.

- ^Theory of ValuebyGérard Debreu.

- ^Hayek cited. Petsoulas, Christina.Hayek's Liberalism and Its Origins: His Idea of Spontaneous Order and the Scottish Enlightenment.Routledge. 2001. p. 2.

- ^Jaffe, Klaus (2014)."Agent Based Simulations Visualize Adam Smith's Invisible Hand by Solving Friedrich Hayek's Economic Calculus".SSRN Electronic Journal.arXiv:1509.04264.doi:10.2139/ssrn.2695557.ISSN1556-5068.S2CID17075259.

- ^Smith, Adam (1827).The Wealth of Nations.Book IV.p. 184Archived2023-01-18 at theWayback Machine.

- ^Smith, Adam(1776). "2".The Wealth of Nations.Vol. 1. London: W. Strahan and T. Cadell.

- ^Hacker, Jacob S.;Pierson, Paul(2010).Winner-Take-All Politics: How Washington Made the Rich Richer – and Turned Its Back on the Middle Class.Simon & Schuster. p. 55.

- ^abJudd, K. L. (1997)."Computational economics and economic theory: Substitutes or complements?"(PDF).Journal of Economic Dynamics and Control.21(6): 907–942.doi:10.1016/S0165-1889(97)00010-9.S2CID55347101.Archived(PDF)from the original on 2020-05-20.Retrieved2019-08-08.

- ^"Chapter 20: Reasons for government intervention in the market".Archived fromthe originalon 2014-05-22.Retrieved2014-06-06.

- ^"Farm Program Pays $1.3 Billion to People Who Don't Farm".Washington Post.2 July 2006.Archivedfrom the original on 4 September 2021.Retrieved3 June2014.

- ^"Ip, Greg and Mark Whitehouse," How Milton Friedman Changed Economics, Policy and Markets ",Wall Street Journal Online(November 17, 2006) "(PDF).Archived(PDF)from the original on 2010-06-25.

- ^"Bad Samaritans: The Myth of Free Trade and the Secret History of Capitalism",Ha-Joon Chang, Bloomsbury Press,ISBN978-1596915985[page needed]

- ^Tarbell, Ida(1904).The History of the Standard Oil Company.McClure, Phillips and Co.

- ^ab"Free market".Encyclopædia Britannica.Archivedfrom the original on 2022-10-20.Retrieved2022-10-15.

- ^abSaul, JohnThe End of Globalism.

- ^"Cliche #41:" Rockefeller’s Standard Oil Company Proved That We Needed Anti-Trust Laws to Fight Such Market Monopolies "Archived2017-02-16 at theWayback Machine,The Freeman,January 23, 2015. Retrieved December 20, 2016.

- ^"Why We Need To Re-think Friedman's Ideas About Monopolies".ProMarket.2021-04-25.Archivedfrom the original on 2021-09-27.Retrieved2021-09-27.

- ^"Cornel West: Democracy Matters"Archived2014-10-15 at theWayback Machine,The Globalist,January 24, 2005. Retrieved October 9, 2014.

- ^Michael J. Sandel(June 2013).Why we shouldn't trust markets with our civic lifeArchived2015-05-21 at theWayback Machine.TED.Retrieved January 11, 2015.

- ^Henry Farrell (July 18, 2014).The free market is an impossible utopiaArchived2015-09-15 at theWayback Machine.The Washington Post.Retrieved January 11, 2015.

- ^Polanyi, Karl (2001-03-28).The Great Transformation: The Political and Economic Origins of Our Time.Beacon Press. p. 60.ISBN978-0-8070-5642-4.Archivedfrom the original on 2023-01-04.Retrieved2023-01-04.

- ^McNally, David (1993).Against the Market: Political Economy, Market Socialism and the Marxist Critique.Verso.ISBN978-0860916062.

Further reading[edit]

- Adler, Jonathan H.“Excerpts from ‘About Free-Market Environmentalism.’” In Environment and Society: A Reader, edited by Christopher Schlottmann, Dale Jamieson, Colin Jerolmack, Anne Rademacher, and Maria Damon, 259–264.New York University Press,2017.doi:10.2307/j.ctt1ht4vw6.38.

- Althammer, Jörg. “Economic Efficiency and Solidarity: The Idea of a Social Market Economy.” Free Markets with Sustainability and Solidarity, edited by Martin Schlag and Juan A. Mercaso,Catholic University of America Press,2016, pp. 199–216,doi:10.2307/j.ctt1d2dp8t.14.

- Baradaran, Mehrsa.“The Free Market Confronts Black Poverty.” The Color of Money: Black Banks and the Racial Wealth Gap,Harvard University Press,2017, pp. 215–246,JSTORj.ctv24w649g.10.

- Barro, R.J. (2003).Nothing is Sacred: Economic Ideas for the New Millennium.The MIT Press.MIT Press.ISBN978-0262250511.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Basu, K.(2016).Beyond the Invisible Hand: Groundwork for a New Economics.Princeton University Press.ISBN978-0691173696.LCCN2010012135.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Baumol, William J.(2014).The Free-Market Innovation Machine: Analyzing the Growth Miracle of Capitalism.Princeton University Press.ISBN978-1400851638.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Block, FredandSomers, Margaret R.(2014).The Power of Market Fundamentalism: Karl Polanyi's CritiqueArchived2021-04-29 at theWayback Machine.Harvard University Press.ISBN0674050711.JSTORj.ctt6wpr3f.7.

- Boettke, Peter J."What Went Wrong with Economics?",Critical ReviewVol. 11, No. 1, pp. 35, 58Archived2007-12-01 at theWayback Machine.

- Boudreaux, Donald(2008)."Free-Market Economy".InHamowy, Ronald(ed.).Archived copy.The Encyclopedia of Libertarianism.Thousand Oaks, CA:Sage;Cato Institute.pp. 187–189.ISBN978-1412965804.LCCN2008009151.OCLC750831024.Archivedfrom the original on 2023-01-09.Retrieved2022-03-20.

{{cite encyclopedia}}:CS1 maint: archived copy as title (link) - Burgin, A. (2012).The Great Persuasion: Reinventing Free Markets since the Depression.Harvard University Press.ISBN978-0674067431.LCCN2012015061.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Chua, Beng Huat.“Disrupting Free Market: State Capitalism and Social Distribution.”Liberalism Disavowed: Communitarianism and State Capitalism in Singapore,Cornell University Press,2017, pp. 98–122,JSTOR10.7591/j.ctt1zkjz35.7.

- Cox, Harvey(2016).The Market as GodArchived2016-11-11 at theWayback Machine.Harvard University Press.ISBN978-0674659681.

- Cremers, Janand Ronald Dekker. “Labour Arbitrage on European Labour Markets: Free Movement and the Role of Intermediaries.”Towards a Decent Labour Market for Low Waged Migrant Workers,edited by Conny Rijken and Tesseltje de Lange,Amsterdam University Press,2018, pp. 109–128,JSTORj.ctv6hp34j.7.

- de La Pradelle, M. and Jacobs, A. and Katz, J. (2006).Market Day in Provence.Fieldwork Encounters And Discoveries, Ed. Robert Emerson And Jack Katz. University of Chicago Press.ISBN978-0226141848.LCCN2005014063.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

{{cite book}}:CS1 maint: multiple names: authors list (link) - Eichner, M. (2019).The Free-Market Family: How the Market Crushed the American Dream (and How It Can Be Restored).Oxford University Press.ISBN978-0190055486.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Ferber, M.A. and Nelson, J.A. (2009).Beyond Economic Man: Feminist Theory and Economics.University of Chicago Press.ISBN978-0226242088.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

{{cite book}}:CS1 maint: multiple names: authors list (link) - Fox, M.B. and Glosten, L. and Rauterberg, G. (2019).The New Stock Market: Law, Economics, and Policy.Columbia University Press.ISBN978-0231543934.LCCN2018037234.Archivedfrom the original on 2022-10-24.Retrieved2022-10-24.

{{cite book}}:CS1 maint: multiple names: authors list (link) - Friedman, M.andFriedman, R.D.(1962).Capitalism and Freedom.Phoenix Book: business/economics.University of Chicago Press.ISBN978-0226264011.LCCN62019619.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

{{cite book}}:CS1 maint: multiple names: authors list (link) - Garrett, G. and Bates, R.H. and Comisso, E. and Migdal, J. and Lange, P. and Milner, H. (1998).Partisan Politics in the Global Economy.Cambridge Studies in Comparative Politics. Cambridge University Press.ISBN978-0521446907.LCCN97016731.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

{{cite book}}:CS1 maint: multiple names: authors list (link) - Group of Lisbon Staff and Cara, J. (1995).Limits to Competition.MIT Press.ISBN978-0262071642.LCCN95021461.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Harcourt, Bernard E.(2011).The Illusion of Free Markets: Punishment and the Myth of Natural Order.Harvard University Press.ISBN978-0674059368.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Hayek, Friedrich A.(1948).Individualism and Economic Order.Chicago: University of Chicago Press. vii, 271, [1].

- Helleiner, Eric;Pickel, Andreas (2005).Economic Nationalism in a Globalizing World.Cornell studies in political economy.Cornell University Press.ISBN978-0801489662.LCCN2004015590.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Higgs, Kerryn. “The Rise of Free Market Fundamentalism.” Collision Course: Endless Growth on a Finite Planet,The MIT Press,2014, pp. 79–104,JSTORj.ctt9qf93v.11.

- Holland, Eugene W. “Free-Market Communism.” Nomad Citizenship: Free-Market Communism and the Slow-Motion General Strike, NED-New edition,University of Minnesota Press,2011, pp. 99–140,JSTOR10.5749/j.ctttsw4g.8.

- Hoopes, James. “Corporations as Enemies of the Free Market.” Corporate Dreams: Big Business in American Democracy from the Great Depression to the Great Recession,Rutgers University Press,2011, pp. 27–32,JSTORj.ctt5hjgkf.8.

- Howell, D.R. (2005).Fighting Unemployment: The Limits of Free Market Orthodoxy.Oxford University Press.ISBN978-0195165852.LCCN2004049283.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Jónsson, Örn D., and Rögnvaldur J. Sæmundsson. “Free Market Ideology, Crony Capitalism, and Social Resilience.” Gambling Debt: Iceland's Rise and Fall in the Global Economy, edited by E. Paul Durrenberger and Gisli Palsson,University Press of Colorado,2015, pp. 23–32,JSTORj.ctt169wdcd.8.

- Kuhner, T.K. (2014).Capitalism v. Democracy: Money in Politics and the Free Market Constitution.Stanford University Press.ISBN978-0804791588.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Kuttner, Robert,"The Man from Red Vienna" (review of Gareth Dale,Karl Polanyi:A Life on the Left,Columbia University Press,381 pp.),The New York Review of Books,vol. LXIV, no. 20 (21 December 2017), pp. 55–57. "In sum, Polanyi got some details wrong, but he got the big picture right. Democracy cannot survive an excessively free market; and containing the market is the task of politics. To ignore that is to courtfascism."(Robert Kuttner, p. 57).

- Lowe, A. and Adolph, L. and Pulrang, S. and Nell, E.J. (1976).The Path of Economic Growth.Cambridge University Press.ISBN978-0521208888.LCCN75038186.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

{{cite book}}:CS1 maint: multiple names: authors list (link) - McGowan, T. (2016).Capitalism and Desire: The Psychic Cost of Free Markets.Columbia University Press.ISBN978-0231542210.LCCN2016005309.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Mittermaier, Karl and Isabella Mittermaier. “Free-Market Dogmatism and Pragmatism.” InThe Hand Behind the Invisible Hand: Dogmatic and Pragmatic Views on Free Markets and the State of Economic Theory,1st ed., 23–26.Bristol University Press,2020.doi:10.2307/j.ctv186grks.10.

- Newland, Carlos. “Is Support for Capitalism Declining around the World? A Free-Market Mentality Index, 1990–2012.” TheIndependent Review,vol. 22, no. 4,Independent Institute,2018, pp. 569–583,JSTOR26591762.

- Noriega, Roger F.,and Andrés Martínez-Fernández. "The Free-Market Moment: Making Grassroots Capitalism Succeed Where Populism Has Failed".American Enterprise Institute,2016,JSTORresrep03243.

- Orłowska, Agnieszka. “Toward Mutual Understanding, Respect, and Trust: On Past and Present Dog Training in Poland.”Free Market Dogs: The Human-Canine Bond in Post-Communist Poland,edited by Michał Piotr Pręgowski and Justyna Włodarczyk,Purdue University Press,2016, pp. 35–60,doi:10.2307/j.ctt16314wm.7.

- Ott, Julia C. “The ‘Free and Open Market’ Responds.”When Wall Street Met Main Street,Harvard University Press,2011, pp. 36–54,JSTORj.ctt2jbtz3.5.

- Palda, Filip(2011)Pareto's Republic and the New Science of Peace2011HomeArchived2022-01-27 at theWayback Machinechapters online. Published by Cooper-Wolfling.ISBN978-0987788009.

- Philippon, Thomas.“The Rise in Market Power.”The Great Reversal: How America Gave Up on Free Markets,Harvard University Press,2019, pp. 45–61,JSTORj.ctv24w62m5.7.

- Quiggin, John(2019).Economics in Two Lessons: Why Markets Work So Well, and Why They Can Fail So Badly.Princeton University Press.ISBN978-0691217420.Archivedfrom the original on 2023-01-18.Retrieved2022-03-11.

- Roberts, Alasdair.“The Market Comes Back.”The End of Protest: How Free-Market Capitalism Learned to Control Dissent,Cornell University Press,2013, pp. 41–57,JSTOR10.7591/j.ctt20d88nv.6.

- Robin, Ron.“Castrophobia and the Free Market: The Wohlstetters’ Moral Economy.”The Cold World They Made: The Strategic Legacy of Roberta and Albert Wohlstetter,Harvard University Press,2016, pp. 118–138,JSTORj.ctv253f7gh.8.

- Sandel, Michael J.(2013).What Money Can't Buy: The Moral Limits of Markets.Farrar, Straus and Giroux.ISBN0374533652.

- Sim, Stuart.“Neoliberalism, Financial Crisis, and Profit.”Addicted to Profit: Reclaiming Our Lives from the Free Market,Edinburgh University Press,2012, pp. 70–95,JSTOR10.3366/j.ctt1g0b72g.9.

- Singer, Joseph W.“Why Consumer Protection Promotes the Free Market.”No Freedom without Regulation: The Hidden Lesson of the Subprime Crisis,Yale University Press,2015, pp. 58–94,JSTORj.ctt175729r.5.

- Sloman, Peter. “Welfare in a Neoliberal Age: The Politics of Redistributive Market Liberalism.” InThe Neoliberal Age?: Britain since the 1970s,edited by Aled Davies, Ben Jackson, and Florence Sutcliffe-Braithwaite, 75–93.UCL Press,2021.JSTORj.ctv1smjwgq.11.

- Starrett, D.A. and Hahn, F.H. (1988).Foundations in Public Economics.Cambridge Economic Handbooks. Cambridge University Press.ISBN978-0521348010.LCCN87027892.

{{cite book}}:CS1 maint: multiple names: authors list (link) - Stiglitz, Joseph.(1994).Whither Socialism?Cambridge, Massachusetts: MIT Press.

- Symons, Michael. “Free The Market! (It's Been Captured by Capitalism).”Meals Matter: A Radical Economics Through Gastronomy,Columbia University Press,2020, pp. 225–246,JSTOR10.7312/symo19602.15.

- Sunstein, C.R.(1999).Free Markets and Social Justice.Oxford University Press.ISBN978-0195356175.

- Tanzi, V. (2011).Government versus Markets: The Changing Economic Role of the State.Cambridge University Press.ISBN978-1139499736.[permanent dead link]

- Taylor, Lance (2011).Maynard's Revenge: The Collapse of Free Market Macroeconomics.Harvard University Press.doi:10.2307/j.ctv1m592k8.12.ISBN978-0674059535.

- Tomasi, J. (2013).Free Market Fairness.Princeton University Press.ISBN978-0691158143.LCCN2011037125.pp. 226–266,JSTORj.ctt7stpz.12.

- Turner, A.(2012).Economics After the Crisis: Objectives and Means.Lionel Robbins Lectures. MIT Press.ISBN978-0262300995.

- Verhaeghe, Paul(2014).What About Me? The Struggle for Identity in a Market-Based Society.Scribe Publications.ISBN1922247375.

- Vogel, S.K.(1998).Freer Markets, More Rules: Regulatory Reform in Advanced Industrial Countries.Cornell paperbacks.Cornell University Press.ISBN978-0801485343.LCCN96005054.

- Zeitlin, Steve, andBob Holman.“Free Market Flavor: Poetry of the Palate.”The Poetry of Everyday Life: Storytelling and the Art of Awareness,1st ed.,Cornell University Press,2016, pp. 127–131,JSTOR10.7591/j.ctt1d2dmnj.17.

External links[edit]

Media related toFree marketat Wikimedia Commons

Media related toFree marketat Wikimedia Commons- "Free market"atEncyclopædia Britannica

- "Free Enterprise: The Economics of Cooperation"looks at how communication, coordination and cooperation interact to make free markets work