Mexican peso crisis

| History ofMexico |

|---|

|

| Timeline |

|

|

TheMexican peso crisiswas acurrency crisissparked by the Mexican government's suddendevaluationof thepesoagainst theU.S. dollarin December 1994, which became one of the first internationalfinancial crisesignited bycapital flight.[1]

During the1994 presidential election,the incumbent administration embarked on an expansionary fiscal and monetary policy. TheMexican treasurybegan issuingshort-termdebtinstruments denominated in domestic currency with a guaranteed repayment in U.S. dollars, attracting foreign investors. Mexico enjoyed investorconfidenceand new access to international capital following its signing of theNorth American Free Trade Agreement(NAFTA). However, aviolent uprisingin the state ofChiapas,as well as the assassination of the presidential candidateLuis Donaldo Colosio,resulted in political instability, causing investors to place an increasedrisk premiumon Mexican assets.

In response, the Mexican central bank intervened in the foreign exchange markets to maintain the Mexican peso'spegto the U.S. dollar by issuing dollar-denominated public debt to buy pesos. The peso's strength caused demand for imports to increase in Mexico, resulting in atrade deficit.Speculatorsrecognized an overvalued peso and capital began flowing out of Mexico to the United States, increasing downward market pressure on the peso. Under election pressures, Mexico purchased its own treasury securities to maintain itsmoney supplyand avert rising interest rates, drawing down the bank's dollar reserves. Supporting the money supply by buying more dollar-denominated debt while simultaneously honoring such debt depleted the bank's reserves by the end of 1994.

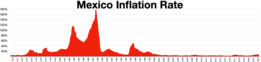

The central bank devalued the peso on December 20, 1994, and foreign investors' fear led to an even higherrisk premium.To discourage the resulting capital flight, the bank raised interest rates, but highercosts of borrowingmerely hurt economic growth. Unable to sell new issues of public debt or efficiently purchase dollars with devalued pesos, Mexico faced adefault.Two days later, the bank allowed the peso tofloat freely,after which it continued to depreciate. The Mexican economy experiencedinflationof around 52% andmutual fundsbegan liquidating Mexican assets as well asemerging marketassets in general. The effects spread to economies in Asia and the rest of Latin America. The United States organized a $50 billion bailout for Mexico in January 1995, administered by theInternational Monetary Fund(IMF) with the support of theG7andBank for International Settlements.In the aftermath of the crisis, several of Mexico's banks collapsed amidst widespread mortgage defaults. The Mexican economy experienced a severerecessionand poverty and unemployment increased.

Precursors

[edit]

With 1994 being the final year of his administration'ssexenio(the country's six-year executive term limit), then-PresidentCarlos Salinas de GortariendorsedLuis Donaldo Colosioas theInstitutional Revolutionary Party's (PRI) presidential candidate for Mexico's1994 general election.In accordance with party tradition during election years, Salinas de Gortari began an unrecorded spending spree. Mexico'scurrent account deficitgrew to roughly 7% ofGDPthat same year, and Salinas de Gortari allowed theSecretariat of Finance and Public Credit,Mexico'streasury,to issue short-term peso-denominated treasury bills with a guaranteed repayment denominated in U.S. dollars, called "tesobonos".These bills offered a loweryieldthan Mexico's traditional peso-denominated treasury bills, called "cetes",but their dollar-denominated returns were more attractive to foreign investors.[2]: 8–10 [3]: 14

Investor confidence rose after theNorth American Free Trade Agreement(NAFTA) was signed. Upon NAFTA's entry into force on January 1, 1994, Mexican businesses as well as the Mexican government enjoyed access to new foreign capital thanks to foreign investors eager to lend more money.[4]That yearChase Manhattan Bankalone held an estimated $1.5 billion in Mexican securities.[5]International perceptions of the country'spolitical riskbegan to shift, however, when theZapatista Army of National Liberationdeclared war on the Mexican government and began aviolent insurrectioninChiapas.Investors further questioned Mexico's political uncertainties and stability when PRI presidential candidateLuis Donaldo Colosiowasassassinatedwhile campaigning inTijuanain March 1994, and began setting higherrisk premiumson Mexican financial assets. Higher premiums initially had no effect on the peso's value because Mexico had afixed exchange rate.[4]: 375

Banco de México,the central bank, maintained the peso's value through an exchange rate peg to the U.S. dollar, allowing the peso toappreciate or depreciateagainst the dollar within a narrow band. To accomplish this, the central bank would frequentlyintervenein the open markets and buy or sell pesos to maintain the peg. The central bank's intervention strategy partly involved issuing new short-term public debt instruments denominated in U.S. dollars. They then used the borrowed dollar capital to purchase pesos in theforeign exchange market,which, in turn, caused the peso to appreciate. The bank's purpose in mitigating the peso's depreciation was to protect against inflationary risks of having a markedly weaker domestic currency, but with the peso stronger than it ought to have been, domestic businesses and consumers began purchasing increasingly more imports, and Mexico began running a largetrade deficit.[6]: 179–180 Speculatorsbegan recognizing that the peso was artificially overvalued and led to speculativecapital flightthat further reinforced downward market pressure on the peso.[6]: 179–180

Mexico's central bankdeviated from standard central banking policy when it fixed the peso to the dollar in 1988. Instead of allowing itsmonetary baseto contract and its interest rates to rise, the central bank purchased treasury bills to prop up its monetary base and prevent rising interest rates—especially given that 1994 was anelection year.Additionally, servicing the tesobonos with U.S. dollar repayments further drew down the central bank's foreign exchange reserves.[2]: 8–10 [4]: 375 [7]: 451–452 Consistent with themacroeconomic trilemmain which a country with a fixed exchange rate and free flow offinancial capitalsacrificesmonetary policyautonomy, the central bank's interventions to revalue the peso caused Mexico's money supply to contract (without an exchange rate peg, the currency would have been allowed to depreciate). The central bank's foreign exchange reserves began to dwindle and it completely ran out of U.S. dollars in December 1994.[4]: 375

Crisis

[edit]On December 20, 1994, newly inaugurated PresidentErnesto Zedilloannounced the Mexican central bank's devaluation of the peso between 13% and 15%.[1]: 50 [2]: 10 [6]: 179–180 Devaluing the peso after previous promises not to do so led investors to be skeptical of policymakers and fearful of additional devaluations. Investors flocked to foreign investments and placed even higher risk premia on domestic assets. This increase in risk premia placed additional upward market pressure on Mexican interest rates as well as downward market pressure on the Mexican peso.[4]: 375 Foreign investors anticipating further currency devaluations began rapidly withdrawing capital from Mexican investments and selling off shares of stock as theMexican Stock Exchangeplummeted. To discourage such capital flight, particularly from debt instruments, the Mexican central bank raised interest rates, but higher borrowing costs ultimately hinderedeconomic growthprospects.[6]: 179–180

When the time came for Mexico to roll over itsmaturingdebt obligations, few investors were interested in purchasing new debt.[4]: 375 To repay tesobonos, the central bank had little choice but to purchase dollars with its severely weakened pesos, which proved extremely expensive.[6]: 179–180 The Mexican government faced an imminentsovereign default.[4]: 375

On December 22, the Mexican government allowed the peso tofloat,after which the peso depreciated another 15%.[6]: 179–180 The value of the Mexican peso depreciated roughly 50% from 3.4MXN/USD to 7.2, recovering only to 5.8 MXN/USD four months later. Prices in Mexico rose by 24% over the same four months, and totalinflationin 1995 was 52%.[2]: 10 Mutual funds,which had invested in over $45 billion worth of Mexican assets in the several years leading up to the crisis, began liquidating their positions in Mexico and otherdeveloping countries.Foreign investors not only fled Mexico butemerging marketsin general, and the crisis led tofinancial contagionthroughout other financial markets inAsiaandthe Americas.[1]: 50 US investors in Mexican securities risked losses of $8 to 10 billion.[5]The impact of Mexico's crisis inChileandBrazilbecame known as the "Tequila effect" (Spanish:efecto tequila).[8]

Bailout

[edit]In January 1995, U.S.President Bill Clintonheld a meeting with newly confirmedU.S. Treasury SecretaryRobert Rubin,U.S. Federal Reserve ChairmanAlan Greenspanand then-Under Secretary for the TreasuryLarry Summersto discuss an American response. According to Summers' recollection of the meeting:

Secretary Rubin set the stage for it briefly. Then, as was his way, he turned to someone else, namely me, to explain the situation in more detail and our proposal. And I said that I felt that$25 billionwas required, and one of the President’s political advisers said, “Larry, you mean$25 million.”And I said, “No, I mean$25billion.”... There was a certain pall over the room, and one of his [Clinton's] other political advisers said, “Mr. President, if you send that money to Mexico and it doesn’t come back before 1996, you won’t be coming back after 1996.”[9]

Clinton decided nevertheless to seek Congressional approval for a bailout and began working with Summers to secure commitments from Congress.

Motivated to deter a potential surge inillegal immigrationand to mitigate the spread of investors' lack ofconfidencein Mexico to other developing countries, the United States coordinated a $50 billionbailoutpackage in January 1995, to be administered by the IMF with support from theG7and theBank for International Settlements(BIS). The package establishedloan guaranteesfor Mexican public debt aimed at alleviating its growing risk premia and boosting investor confidence in its economy. TheMexican economyexperienced a severerecessionand the peso's value deteriorated substantially despite the bailout's success in preventing a worsecollapse.Growth did not resume until the late 1990s.[1]: 52 [2]: 10 [4]: 376

Theconditionalityof the bailout required the Mexican government to institute newmonetaryandfiscal policycontrols, although the country refrained frombalance of paymentsreforms such as tradeprotectionismand strictcapital controlsto avoid violating its commitments underNAFTA.The loan guarantees allowed Mexico to restructure its short-term public debt and improvemarket liquidity.[2]: 10–11 Of the approximately$50 billionassembled in the bailout,$20 billionwas contributed by the United States,$17.8 billionby the IMF,$10 billionby the BIS,$1 billionby a consortium of Latin American nations, andCAD$1 billion by Canada.[10]: 20

TheClinton administration's efforts to organize a bailout for Mexico were met with difficulty. It drew criticism from members of theU.S. Congressas well as scrutiny from thenews media.[1]: 52 The administration's position centered on three principal concerns: potentialunemployment in the United Statesin the event Mexico would have to reduce its imports of U.S. goods (at the time, Mexico was the third-largest consumer of U.S. exports);political instabilityand violence in a neighboring country; and a potential surge inillegal immigrationfrom Mexico. Some congressional representatives agreed with American economist and former Chairman of theFederal Deposit Insurance Corporation,L. William Seidman,that Mexico should just negotiate with creditors without involving the United States, especially in the interest of deterringmoral hazard.On the other hand, supporters of U.S. involvement such asFed ChairAlan Greenspanargued that the fallout from a Mexicansovereign defaultwould be so devastating that it would far exceed the risks of moral hazard.[11]: 16

Following theU.S. Congress's failure to pass the Mexican Stabilization Act, theClinton administrationreluctantly approved an initially dismissed proposal to designate funds from theU.S. Treasury'sExchange Stabilization Fundas loan guarantees for Mexico.[12]: 159 These loans returned a handsome profit of $600 million and were even repaid ahead of maturity.[2]: 10–11 Then-U.S. Treasury SecretaryRobert Rubin's appropriation of funds from the Exchange Stabilization Fund in support of the Mexican bailout was scrutinized by theUnited States House Committee on Financial Services,which expressed concern about a potentialconflict of interestbecause Rubin had formerly served as co-chair of the board of directors ofGoldman Sachs,which had a substantial share in distributing Mexican stocks and bonds.[13]

Economic impacts

[edit]Mexico's economyexperienced a severerecessionas a result of the peso's devaluation and the flight to safer investments. The country's GDP declined by 6.2% over the course of 1995. Mexico's financial sector bore the brunt of the crisis as banks collapsed, revealing low-quality assets and fraudulent lending practices. Thousands ofmortgageswent intodefaultas Mexican citizens struggled to keep pace with rising interest rates, resulting in widespreadrepossessionof houses.[14][15]

In addition to declining GDP growth, Mexico experienced severe inflation and extreme poverty skyrocketed asreal wagesplummeted andunemploymentnearly doubled. Prices increased by 35% in 1995. Nominal wages were sustained, but real wages fell by 25-35% over the same year. Unemployment climbed to 7.4% in 1995 from its pre-crisis level of 3.9% in 1994. In the formal sector alone, over one million people lost their jobs and average real wages decreased by 13.5% throughout 1995. Overall household incomes plummeted by 30% in the same year. Mexico's extreme poverty grew to 37% in 1996 from 21% in 1994, undoing the previous ten years of successful poverty reduction initiatives. The nation's poverty levels would not begin returning to normal until 2001.[16]: 10

Mexico's growing poverty affectedurban areasmore intensely thanrural areas,in part due to the urban population's sensitivity tolabor marketvolatility and macroeconomic conditions. Urban citizens relied on a healthy labor market,access to credit,and consumer goods.Consumer price inflationand atightening credit marketduring the crisis proved challenging for urban workers, while rural households shifted tosubsistence agriculture.[16]: 11 Mexico's grossincome per capitadecreased by only 17% inagriculture,contrasted with 48% in thefinancial sectorand 35% in theconstructionandcommerceindustries. Average householdconsumptiondeclined by 15% from 1995 to 1996 with a shift in composition toward essential goods. Households saved less and spent less on healthcare.Expatriatesliving abroad increasedremittancesto Mexico, evidenced by average net unilateral transfers doubling between 1994 and 1996.[16]: 15–17

Households' lower demand forprimary healthcareled to a 7% hike inmortality ratesamong infants and children in 1996 (from 5% in 1995).Infant mortalityincreased until 1997, most dramatically in regions where women had to work as a result of economic need.[16]: 21–22

Critical scholars contend that the 1994 Mexican peso crisis exposed the problems of Mexico’s neoliberal turn to theWashington consensusapproach to development. Notably, the crisis revealed the problems of a privatized banking sector within a liberalized yet internationally subordinate economy that is dependent on foreign flows of finance capital.[17]

See also

[edit]- Economic history of Mexico

- 1998 Russian financial crisis

- Great Recession

- Index of Mexico-related articles

- Latin American economy

- Sudden stop (economics)

References

[edit]- ^abcdeEun, Cheol S.; Resnick, Bruce G. (2011).International Financial Management, 6th Edition.New York, NY: McGraw-Hill/Irwin.ISBN978-0-07-803465-7.: 50–52

- ^abcdefgHufbauer, Gary C.; Schott, Jeffrey J. (2005).NAFTA Revisited: Achievements and Challenges.Washington, D.C.:Peterson Institute for International Economics.ISBN978-0-88132-334-4.

- ^Carmen M. Reinhart;Kenneth S. Rogoff(2009).This Time is Different: Eight Centuries of Financial Folly.Princeton, NJ:Princeton University Press.ISBN978-0-691-14216-6.

- ^abcdefghMankiw, N. Gregory (2013).Macroeconomics, 8th Edition.New York, NY: Worth Publishers.ISBN978-1-42-924002-4.

- ^abHerrmann, Joshi (2015-07-15)."What Thatcherite union buster Sajid Javid learned on Wall Street".The Guardian.ISSN0261-3077.Retrieved2024-07-10.

- ^abcdefJeff Madura (2007).International Financial Management(Abridged 8th ed.). Mason, OH: Thomson South-Western.ISBN978-0-324-36563-4.

- ^Victoria Miller (2000). "Central bank reactions to banking crises in fixed exchange rate regimes".Journal of Development Economics.63(2): 451–472.doi:10.1016/s0304-3878(00)00110-3.

- ^"Tequila Effect".Investopedia.Retrieved2014-07-06.

- ^"Larry Summers on his Work in the Clinton and Obama Administrations".

- ^Lustig, Nora (1995)."The Mexican Peso Crisis: The Foreseeable and the Surprise"(PDF).Brookings Institution: 1–27. Archived fromthe original(PDF)on 2015-09-24.Retrieved2014-07-08.

{{cite journal}}:Cite journal requires|journal=(help) - ^Joseph A. Whitt Jr. (1996)."The Mexican Peso Crisis"(PDF).Economic Review.Federal Reserve Bank of Atlanta:1–20. Archived fromthe original(PDF)on 2014-06-11.Retrieved2014-07-08.

- ^Alan Greenspan(2007).The Age of Turbulence: Adventures in a New World.London, UK: Penguin Books.ISBN978-1-59420-131-8.

- ^Keith Bradsher (March 2, 1995)."House Votes to Request Clinton Data on Mexico".The New York Times.Retrieved2014-07-12.

- ^"The peso crisis, ten years on: Tequila slammer".The Economist.2004-12-29.Retrieved2014-07-08.

- ^"The Tequila crisis in 1994".Rabobank.2013-09-19. Archived fromthe originalon 2015-04-10.Retrieved2014-07-27.

- ^abcdPereznieto, Paola (2010).The Case of Mexico's 1995 Peso Crisis and Argentina's 2002 Convertibility Crisis: Including Children in Policy Responses to Previous Economic Crises(PDF)(Report). UNICEF. Archived fromthe original(PDF)on 2021-02-26.Retrieved2014-07-27.

- ^Marois, Thomas (2012).States, Banks and Crisis: Emerging Finance Capitalism in Mexico and Turkey.Cheltenham: Edward Elgar.ISBN9780857938572.

Further reading

[edit]- Allen, Larry (2009).The Encyclopedia of Money(2nd ed.).Santa Barbara, CA:ABC-CLIO.pp.279–281.ISBN978-1598842517.

- Luis Pazos (1 January 1995).Devaluación: por qué, qué viene, qué hacer?.Editorial Diana.ISBN978-968-13-2777-4.