Let’s build a Community-First FinTech to improve our Financial Health TOGETHER!

OurBanc is afinancial technologycompany built with today's economy and our dynamic society in mind. We recognize that many people in this country arefinancially unhealthy,with the highest concentration inAfrican Americans,Hispanics,andIndigenous communities— Together, we can change that!

OurBanc isre-engineeringmobile banking to better serve historically disenfranchised communities.

Our Values

OurBanc emphasizes the importance ofTRUSTthrough ourCOMMUNITYand mission-aligned allies. Our customers benefit from enhancedTRANSPARENCYthrough our comprehensive approach to incorporatingFINANCIAL LITERACYand awareness into the mobile banking experience.

Trust

Community and mission-aligned allies

Literacy

Personalized financial education

Our Mission

OurBanc’s mission is to do our part in dismantling the systematic barriers that exist within America's financial system by channeling the transformative power ofpurpose,community,andinnovative technologyto providehistorically disenfranchised peoplewith more transparent and equitable financial products and services.

Our Features & Our Focus

High Level Security

Deposits are FDIC insured up to $250,000 per account and we have Platform Banking regulation encrypted security.

Data Driven

Data - drivenandAI - enabled personalized insightshelps protect, guide, and inform our customers to encouragepositivefinancial behaviors.

+ Benefits

Remote deposit, online savings and checking accounts with no minimum balances or overdraft fees, a vast ATM network, early pay access, fairer lending rates, and access tofinancial literacy.

Best in Class

Remote check deposit

Digital accounts

No minimum balances

No monthly maintenance fees

No overdraft fees

Peer-to-peer transfers

Apple & Android pay

Two-day early pay access

Rebates for out of network ATM fees

Extended customer service

More fair lending products

“Roughly30% of parents with kidsin schools have achallenging relationshipwith theAmerican banking system.”

— PayTheory

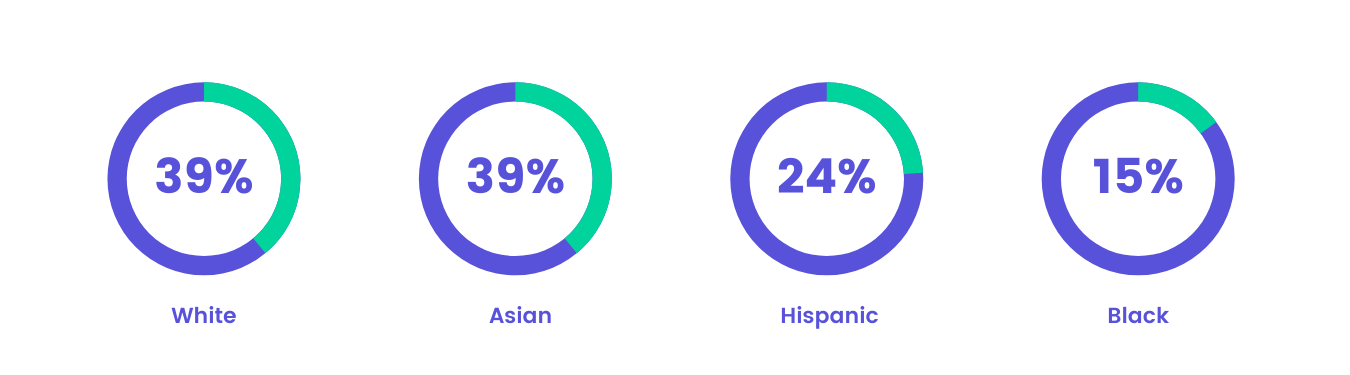

Percentage of people considered financially healthy, by race

(Financial Health Network of America, August 2020)